Second Income

Generator

Generate Second Income in 3 Steps

SIG

What Is ValueFarm SIG?

ValueFarm – Second Income Generator (SIG)

A new way to make your money grow, built for Malaysians who want a smarter second income stream.

Whether you’re working a full-time job or already managing some investments, SIG is here to simplify the process of making your money work for you—consistently, safely, and intelligently.

Check out the benefits

What Is

ValueFarm SIG?

Turning confusion into clarity.

Why We Built This

Because most people want to invest—but few know how to start.

You’ve probably heard phrases like “diversify your portfolio” or “invest in growth stocks,” but those words don’t help when you’re staring at a stock chart or trying to figure out if a company is overvalued.

SIG was built to bridge that gap.

It’s not just a stock-picking tool—it’s an educational investment system designed to help you:

Understand why a stock is worth your attention.

Know when to buy, hold, or exit.

Build a portfolio that generates consistent income, even if the market fluctuates.

How SIG Helps You Grow

SIG doesn’t just tell you what to buy. It teaches you how to think like a smart investor.

We’ve broken the entire investment landscape into three easy-to-follow categories,

each powered by clear logic and historical market principles:

Dividend Stocklist

For Reliable, Income-Focused Investing

Dividends are real, tangible returns paid directly to you. But not all dividend stocks are created equal.

Our system screens for companies that offer:

Plus, we teach you how to interpret these numbers—so over time, you don’t just follow the system, you understand it.

Growth + Stocklist

For Long-Term Wealth Building

Growth stocks are companies that are expanding in size, revenue, and impact. But chasing “growth” without data is gambling.

We focus on:

With this, you learn to distinguish real growth from temporary hype.

Momentum Stocklist

For Riding Smart Trends

Sometimes the best opportunities come from being in the right place at the right time. Momentum investing works—but only when backed by earnings and valuation.

We guide you to:

We don’t just tell you what’s hot. We help you filter what’s real.

Dividend Stocklist

For Reliable, Income-Focused Investing

Dividends are real, tangible returns paid directly to you. But not all dividend stocks are created equal.

Our system screens for companies that offer:

Plus, we teach you how to interpret these numbers—so over time, you don’t just follow the system, you understand it.

Growth + Stocklist

For Long-Term Wealth Building

Growth stocks are companies that are expanding in size, revenue, and impact. But chasing “growth” without data is gambling.

We focus on:

With this, you learn to distinguish real growth from temporary hype.

Momentum Stocklist

For Riding Smart Trends

Sometimes the best opportunities come from being in the right place at the right time. Momentum investing works—but only when backed by earnings and valuation.

We guide you to:

We don’t just tell you what’s hot. We help you filter what’s real.

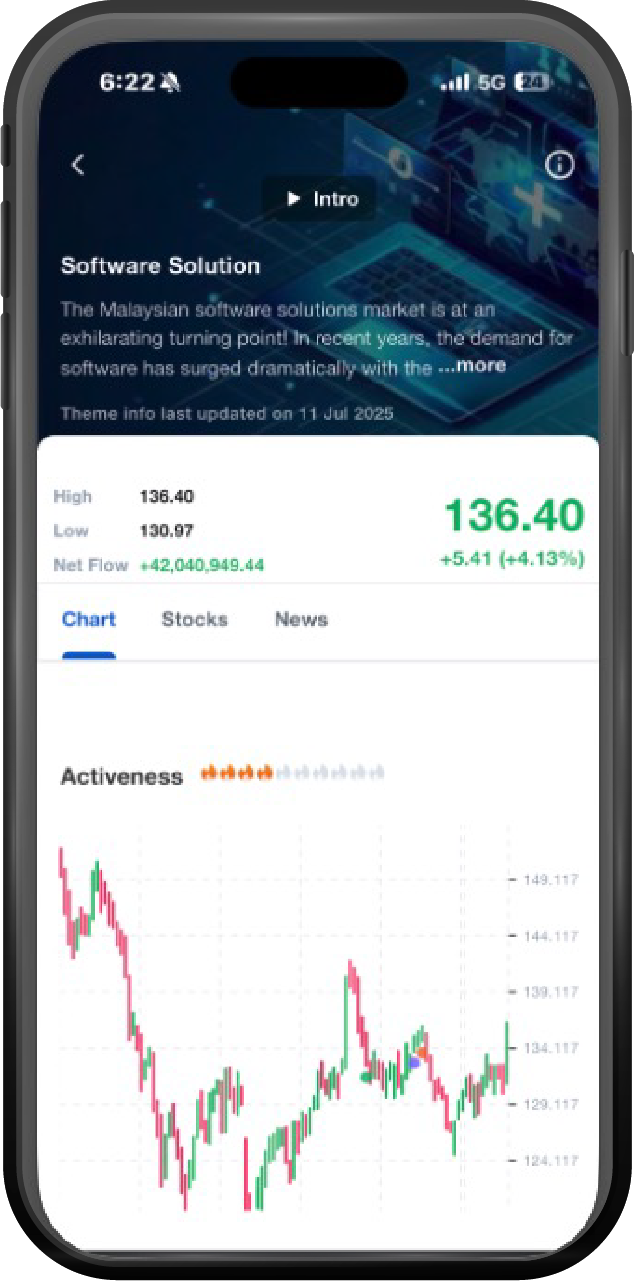

Your Smart Investing Assistant

Because it’s not about reacting fast—it’s about seeing early.

Our AI Insight tool is your assistant behind the scenes. It doesn’t make decisions for you, but it watches your portfolio for key signals:

Two quarters of declining earnings?

You'll get notified.

Sudden price spikes with no earnings support?

You'll know.

Changing business fundamentals?

Time to reassess.

We call this “automated awareness.”

It’s like having an analyst working quietly beside you—without the monthly salary.

Your Built-In Safety Net

Investment is about returns.

But survival comes first.

Markets can crash.

Companies can fail.

But the biggest risk is doing nothing—or reacting too late.

That’s why we built the Braking System:

01.

Logical Warnings

A logic-based checklist that signals when something is seriously wrong.

02.

Hidden Signals

It checks for sudden growth reversals, suspicious market behavior, or deep valuation misalignments.

03.

Early Exit

When triggered, it prompts you to review or exit your position, protecting your capital before damage becomes irreversible.

It’s not fear-based investing—it’s disciplined decision-making.

Audience

Who It’s Designed For

SIG is for you if you’ve ever said:

“I want to invest but I’m not confident.”

“I don’t have time to study every stock.”

“I want my money to grow—but safely.”

Ideal for:

Working professionals who need passive income with smart systems.

Beginners who want structure, not guesswork.

Retirees or soon-to-retire individuals who seek steady, low-risk income.

Curious learners who want to become smarter, long-term investors.

SIG doesn’t replace your judgment — it sharpens it.

See what we're all about

What You’ll Get Inside SIG

We don’t overwhelm you with noise. You’ll get what works.

You don’t just use SIG — you grow with it.

What People Ask Us All the Time

Got questions? You're not alone.

Here are some of the most common things people ask before they get started with SIG.

Click to reveal the answers that matter to you.

No.

SIG offers guidance and logic, not buy/sell calls. You stay in control.

If you want to understand and control your money, YES.

SIG gives you tools + knowledge.

Yes.

SIG is built for simplicity, and each section includes beginner-friendly explanations.

Not at all.

Our system tracks quarterly reports and meaningful shifts—so you can stay focused on life.

Final Call

Smart investing isn’t about luck.

It’s about logic, discipline, and education.

SIG gives you all three—in one intuitive system.

Start your second income journey today.

Your future self will thank you.