Freemium

ValueFarm

Malaysia's Leading AI Investment Tool

From busy professionals to beginners, ValueFarm makes investing easy, fast, and stress-free.

ValueFarm : MALAYSIA'S LEADING AI INVESTMENT TOOL

EFFECTIVE

Your first step to

Smarter Investing.

VALUEFARM FREEMIUM VALUEFARM FREEMIUM VALUEFARM FREEMIUM VALUEFARM

Most people want a INVEST SMARTER

Because they dream of growing wealth with confidence — more clarity, more control, more of what truly matters.

Market Insights & Freedom

Family & Lifestyle Goals

Dreams & Growth

Confidence & Support

ValueFarm is designed to

bring clarity and simplicity.

It helps you understand opportunities quickly, so you can invest with confidence—without the stress of endless data.

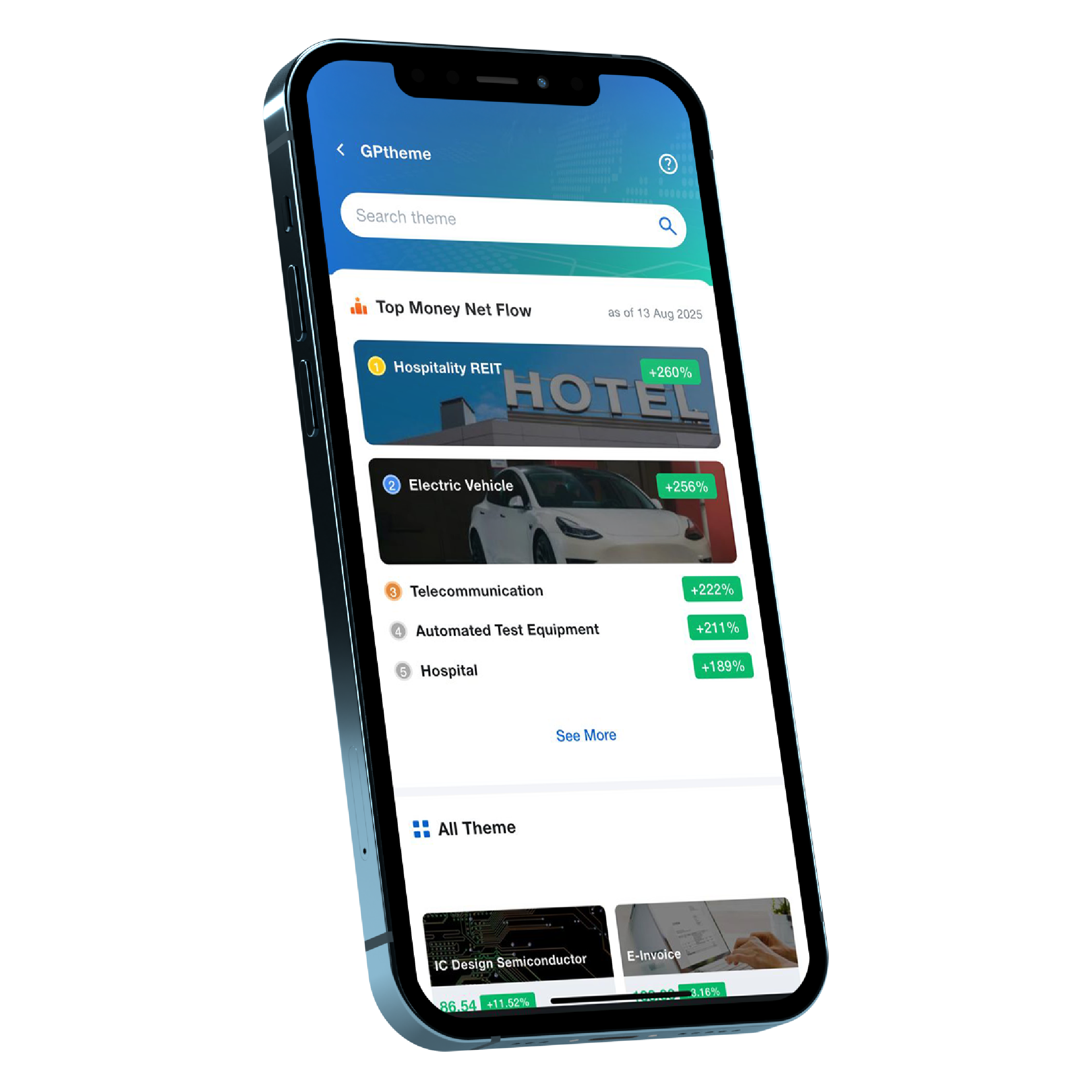

ValueFarm’s 4 Smart Investment Features

01.

Market Insights & Data Analysis

Stay informed, stay ahead.

ValueFarm keeps you connected to the market with clear, timely updates and powerful data at your fingertips.

02.

Understand Financial Health at a Glance

Clear signals, confident choices.

With simple visual indicators, ValueFarm makes it effortless to understand a company’s financial standing.

This gives you instant clarity on whether a business is stable, growing, or worth further review.

03.

AI Insights: Smart Report Analysis

AI-powered clarity in seconds.

ValueFarm’s AI reads reports for you, turning pages of data into clear insights you can act on immediately.

04.

Build Your Own Portfolio & Support

Organized, guided, and supported.

ValueFarm helps you track and grow your portfolio with ease, backed by reliable support whenever you need it.

05.

Spot Hidden Opportunities & Risks

Discover what others often miss.

ValueFarm’s AI uncovers valuable insights and early signals, giving you an edge in every investment decision.

What Makes

ValueFarm Different

VALUEFARM FreeMIUM SIG VALUEFARM FREEMIUM SIG VALUEFARM FREEMIUM SIG VALUEFARM

Why Valuefarm

work.

Scans reports, data, and trends to highlight what truly matters.

Visual signals and structured insights make decisions straightforward.

Market news, company data, and portfolio tracking, all in one place.

Built for busy professionals and beginners alike, with clarity at every step.

Designed to support both steady wealth building and timely opportunities.

VALUEFARM

Your Journey With ValueFarm

From your first step to lasting success.

Every investing journey begins with understanding. ValueFarm provides daily market news, industry updates, and detailed company data all in one place.

You can instantly spot the five hottest stocks and explore 10 years of financial performance, dividends, and highlights.

The platform organizes information clearly, helping you focus on what matters most. Whether you are a beginner or a busy professional, ValueFarm gives you a strong foundation to make informed decisions, start with confidence, and stay ahead in the market with ease and clarity.

Confidence comes from seeing the full picture in a clear, understandable way. ValueFarm uses simple color-coded signals to show a company’s health at a glance — green for healthy or undervalued, blue for steady performance, and orange to highlight areas for attention.

These signals turn complex financial data into easy, actionable insights. By following these indicators, you can make decisions with certainty, strengthen your investing skills over time, and enjoy a smoother, guided experience. Beginners gain reassurance, and experienced investors save time while spotting opportunities effectively.

Annual and quarterly reports can be overwhelming, but ValueFarm’s AI simplifies everything. It scans reports instantly, highlighting key numbers, growth opportunities, and potential risks that investors often overlook.

The AI organizes complex data into clear insights, available in English or Chinese, so you can grasp the essentials quickly.

This allows you to make informed choices with clarity and confidence. Whether you’re evaluating a single stock or reviewing multiple companies, AI-driven insights help you act efficiently, giving you an edge in identifying opportunities and making your investment journey smarter and more guided.

ValueFarm helps you create a personalized portfolio that grows with your goals. You can monitor all your investments in one place, track performance in real time, and follow clear signals to guide your decisions.

The platform keeps everything organized, so you can focus on growing your portfolio rather than managing scattered information. With ValueFarm, portfolio management is smooth, efficient, and empowering.

Every step is designed to give you confidence, whether you’re refining your holdings, tracking trends, or adjusting strategies to stay aligned with your investment objectives.

Long-term success comes from consistent growth and informed decisions. ValueFarm supports both short-term gains and steady wealth building, giving you tools to manage your investments effectively.

With clear signals, AI insights, and organized portfolio tracking, you can focus on growth without stress or uncertainty.

The platform empowers you to act on opportunities, monitor progress, and refine strategies confidently. Over time, this structured approach helps you achieve financial goals, enjoy the benefits of smart investing, and experience a smooth, guided journey that turns knowledge and insights into real, lasting results.

What You’ll Gain

WHO It’s For

Invest efficiently without losing time.

ValueFarm keeps you updated with key market trends and AI-powered insights, allowing you to track investments and make informed decisions quickly, even with a full schedule.

Start confidently with clear guidance.

With easy-to-read signals, step-by-step support, and AI analysis, beginners can navigate the market, understand company health, and grow their portfolio with confidence.

Discover opportunities with clarity.

ValueFarm helps you uncover potential investments, analyze company data, and act on insights efficiently, turning curiosity into smart, actionable decisions.

Build wealth with structure.

Track your portfolio, monitor progress, and receive insights that guide steady growth. ValueFarm supports long-term financial goals with organized and actionable tools.

Make informed decisions with confidence.

Whether evaluating opportunities or assessing risks, ValueFarm’s AI highlights key insights, empowering strategic investors to make smart decisions and maximize potential outcomes.

How ValueFarm Works

Easy, fast, and stress-free investing for everyone.

Imagine Your Life With Valuefarm

Financial Freedom Ahead

Build wealth your way.

With ValueFarm, you can invest confidently and efficiently, turning insights into steady income and long-term growth.

By making smart decisions supported by AI, you gain the freedom to plan your financial future and focus on what truly matters most in your life.

Investing Made Simple

Stress-free and guided.

ValueFarm simplifies complex financial data with AI-powered analysis and clear visual signals.

Investing becomes easy, fast, and enjoyable, allowing you to save time while making informed decisions that support your goals and empower you to act confidently every step of the way.

Dreams Within Reach

Turn goals into reality.

By tracking your portfolio, uncovering hidden opportunities, and growing steadily, ValueFarm helps you achieve personal aspirations.

Whether it’s traveling, spending quality time with family, or enjoying life’s little luxuries, your financial goals become achievable with smart, guided investing.

ValueFarm

VALUEFARM